Annuity Pricing Sensitivity

This article appears at the following website: forbes.com

With all of my discussions of annuities lately, it is worthwhile to also consider the sensitivity of annuity pricing to interest rates, gender and age-related mortality factors.

Relationship Between Payout Rates and Interest Rates

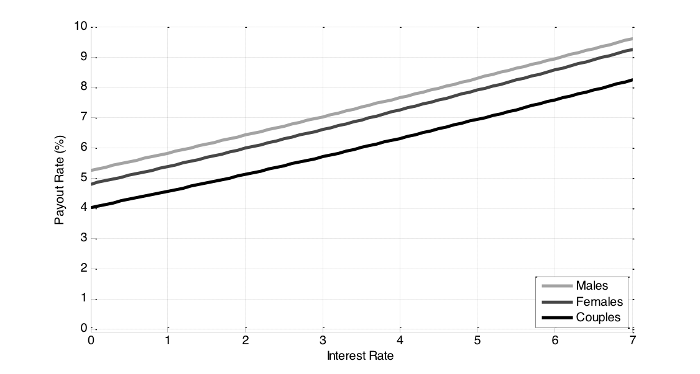

Figure 1 estimates the relationship between annuity payout rates and interest rates for 65-year old males, females, and opposite-gender couples with a joint and 100% survivors annuity. All of the following figures also assume no additional overhead costs are deducted, which appears to be the case in the current pricing environment.

Figure 1: Relationship Between Interest Rates and Annuity Payout Rates For 65-Year-Olds

Females live longer than males and the longest living individual in a couple is expected to outlive their single counterparts, which explains the disparities between payout rates. In late July 2015, immediateannuities.com reported the best payout rate for a 65-year-old male was 6.79%, with 6.53% for females, and 5.76% for couples. With Figure 1, these payout rates correspond to a 2.6% interest rate assumption for males, a 2.9% interest rate assumption for females, and a 3.1% interest rate assumption for couples. This links pricing to Treasury yields with between 10- and 30-year maturities in July 2015. In mid-July, 10-year Treasuries were about 2.4%, while 30-year Treasuries were about 3.2%.

I was hesitant at first to buy an annuity on the internet. Once I got your quote report and read your reviews I was happy I found your website. Your phone reps were always very helpful. You made the whole thing go really simple. Thank you guys!

The higher interest rate assumptions for females and couples make sense. Since they live longer, more of their payments will be further in the future. This way, the insurance company can focus on the longer-end of the yield curve. While I cannot consider all of the factors insurance companies use to adjust their interest-rate and mortality-rate assumptions (insurance companies don’t like sharing this information), these seem to be reasonable estimates for actual annuity payout rates. Overhead costs appear to be quite slim these days, at least for the best price quotes offered in the marketplace.

The more important point about Figure 1 is to see how payout rates fluctuate with interest rates, holding mortality the same. For males, if interest rates rise from 2.5% to 3.5%, the payout rate increases from 6.73% to 7.36%, or a 0.63% increase. With a 4.5% interest rate, the payout rate increases to 7.99%, which is another 0.63% increase.

A similar story can be seen with females and couples, where a 1% increase in interest rates generally raises payout rates by about 0.6% to 0.65%. This is a fairly consistent relationship and one which must be kept in mind when we consider whether it is wise to wait for interest rates to rise before purchasing an income annuity. Interest is only one of the factors determining payout rates, so payout rates will not rise equally with interest rates. Return of principal and mortality credits are also important.

Before shifting to the next important factor for pricing, I want to take a moment to re-express the numbers in Figure 1 in a slightly different way. The reciprocal of the payout rate is the cost of purchasing a dollar of lifetime income. For some readers, this may be more intuitive, and it also provides a better match when thinking about the prices from Blackrock’s CoRI indices. Figure 2 shows these costs.

Figure 2: Relationship Between the Cost of Purchasing $1 of Lifetime Income and Interest Rates, 65-Year-Olds

When interest rates are 2.5%, it costs a 65-year-old male $14.85 to buy one dollar of lifetime income. With 3.5% interest rates, the cost falls to $13.60, and to $12.51 at 4.5% interest rates. Likewise, for females the cost of income falls from $15.86 to $14.41 to $13.17, respectively, as interest rates rise. The respective costs for a couple at these three rates are $18.46, $16.62, and $15.07. Naturally, we can see in Figure 2 how higher interest rates reduce the cost of funding an income stream. We can set aside less today because it will grow at a quicker pace and still provide the same income payments.

Relationship Between Payout Rates and Age

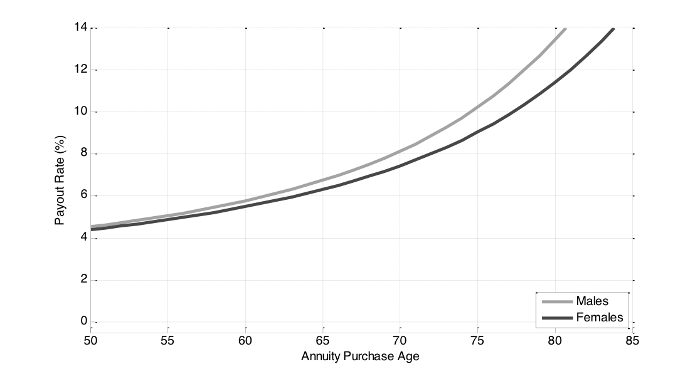

The next set of figures holds interest rates at 2.5% in order to explore more about the relationship between purchase age and payout rates for an immediate annuity. Figure 3 shows payout rates for males and females with purchase ages ranging from 50 to 85. These relationships are not linear. Payout rates rise more quickly as purchase age increases due to higher mortality rates at higher ages.

I estimate age 50 payout rates of 4.52% for males and 4.39% for females. These increase to 5.76% and 5.48%, respectively, at age 60. By 70, the payout rates are 8.11% and 7.42%, respectively, and they increase to 13.43% and 11.38% by age 80. Intuitively, higher ages support higher payout rates because the remaining life expectancy is less, so the annuity provider expects to make fewer payments.

Figure 3: Relationship Between Purchase Age and Annuity Payout Rates, 2.5% Interest Rate

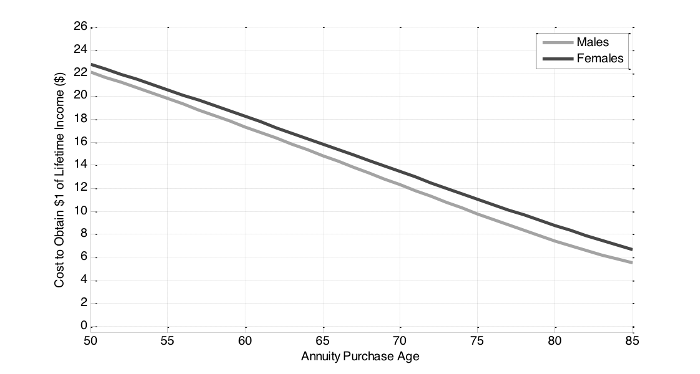

Figure 4 repeats this analysis to show how the cost of one dollar of lifetime income relates to the age it is purchased. The cost decreases with age because every year someone lives before purchasing an income annuity is another year income does not have to be paid. However, the cost does not reduce by one dollar per year. Life expectancy does not reduce on a one-to-one basis as people continue to live, not to mention that premiums will have less time to grow as the purchase is delayed. On average, over this 35-year period, delaying the starting age by one year reduces the cost per one dollar of income by 47 cents for males and 46 cents for females.

Figure 4: Relationship Between the Cost of Purchasing One Dollar of Lifetime Income and Purchase Age, 2.5% Interest Rate

Wade Pfau: Professor at The American College and Principal at McLean Asset Management. His website: www.RetirementResearcher.com

We'd love to hear from you!

Please post your comment or question. It's completely safe – we never publish your email address.

Comments (0)

There are no comments yet. Do you have any questions?