Bonding with Deferred Income Annuities:

Exploring Portfolio Sustainability Options in Retirement

Interest rates may not affect annuity payouts as much as you might think.

Written by Moshe A. Milevsky, Ph.D. For MetLife, 2015

Interest Rates: Fact vs. Fiction

The cost of guaranteed retirement income may be less dependent on interest rates than you and your clients might think. Yet many investors are choosing to wait for interest rates to rise before purchasing an annuity because they believe they'll receive a higher payout.

Your May Ask...

Should I wait until rates rise before purchasing a deferred income annuity (DIA)? Won't a $10,000 DIA get less costly once the Fed increases rates? The quick answer to the first question is: No; and to the second: Not necessarily.

Catch-22

For a while now, market observers have been forecasting interest rates’ imminent ascent, which is apparently bad news for fixed income holdings, since bond prices drop when yields rise. And yet, as the bulk of baby boomers age and transition into retirement, investors are being counseled to reduce portfolio risk by increasing their bond allocation. Can these philosophies be reconciled? I argue the paradox might be resolved with deferred income annuities. This article explains how.

1. Before Bonds, There Were Annuities

Despite the perception that deferred income annuities (DIAs) are relatively novel insurance products and ‘new’ on the financial scene, the concept of a fixed income investment that begins making payments later in life – and for life – has actually been around for hundreds of years. They existed long before insurance companies ever did.

Three centuries ago, the English government needed very large sums of money to finance its war against France. Long-term debt was unheard of back then – a time before omnipotent bond markets and powerful central banks. So, in 1693, in its first attempt to borrow, the Exchequer of England floated a very peculiar life annuity.

In exchange for an upfront investment of one hundred British pounds (£100) – which was a substantial sum in the late 17th century – wealthy investors would be entitled to 7% coupons for as long as they lived. This is a retirement pension, also known as a single premium immediate annuity (SPIA) in the 21st century.

However, in a macabre twist, annuitant investors were told that when they died, their 7% coupon would not be continued by the Exchequer to their beneficiaries or heirs. There would be no death benefit. The original principal would be forfeited. Instead, their coupons would be evenly redistributed to the surviving annuitant investors.

When you think about it carefully, this method of lending money is not as crazy as it sounds. As people age, their interest payments increase – which helps combat inflation or health care expenses – so they are assured longevity insurance.

The Exchequer published a prospectus of sorts with mortality tables, in which it projected the number of survivors expected after 10, 20, 30 and 50 years. These supporting documents helped give purchasers an indication of how much income they would receive over time.

The extra cash flow above and beyond the 7% coupon interest that annuitants received was really “other people’s money” that had been forfeited at death. Today, these so-called mortality credits that form part of the return or yield from a life annuity are the modern day equivalent of other investor’s money.

Using the earlier example, when the annuitant pool was down to half of its original size, the income was 7% interest plus 7% mortality credits for a total yield of 14%. When the pool was down to a quarter of its original size, the payout was 7% interest plus 21% mortality credits for a payout yield of 28%, etc. As time marched on, the majority of survivor income was driven by mortality credits; not the 7% interest. You can think of the death rate every year as a form of interest rate. The survivors earn financial (real) interest plus insurance (dying) interest.

Now, just to be clear, the Exchequer guaranteed absolutely nothing other than the 7% coupon payment to the group. The Exchequer didn’t really care when exactly annuitants died. All it had to pay out was the 7% interest per year until the last annuitant in the pool was gone. Technically speaking, it distributed a FIXED annual sum across a dwindling number of survivors. But the few nonagenarians and centenarians who were expected to survive could look forward to enormous payout yields. So this was one of the early precursors to what today might be called a DIA.

Fast Forward to the 21st Century

For a variety of reasons, the English government (ultimately) abandoned this method of debt financing after the Bank of England was established and bond markets took root.

The Exchequer began issuing long-term bonds, closer to the instruments we are familiar with today. Eventually, insurance companies inherited the business of life annuities. They also sold life insurance to balance or hedge their risk. In fact, life insurance became a much bigger part of their overall business as the growing and wealthier middle class sought to protect their estates from the loss of their human capital. As Defined Benefit (DB) pensions and government social security systems matured and increased in scope, the need for these mass-annuities declined.

But in the early 21st century, with the ongoing decline in DB pension coverage – and with concerns about “outliving one’s money” gnawing at the public consciousness – life annuities and mortality credits are benefiting from a resurrection of sorts, as evidenced by the increased interest and number of companies offering DIAs to the public.

Today, insurance companies guarantee the mortality credits that were random and unpredictable in the 17th century. They do this by (i.) making prudent and conservative assumptions about how many annuitants are expected to survive and (ii.) selling enough annuities to benefit from risk diversification, which is known (mathematically) as the Law of Large Numbers (LLN). Moreover, the insurance company is ‘on the hook’ if these forecasts prove inaccurate. Pricing assumptions aren’t made lightly, since the lifetime of income can never be reduced.

Also, to smooth cash flows over time, annuity issuers even-out the lifetime income so it isn’t only the surviving centenarians who benefit. For example, if the insurance actuaries expect 300 basis points of mortality (credits) at age 90, they might ‘spend’ some of it on 70-year-olds to level off the payment stream. Yes, the actuarial science can get messy, but rest assured, regardless of the exact recipe, the mortality credits are still there embedded inside the price paid and helping subsidize interest rates.

Today, a SPIA sold to a 75-year-old might offer yields of 8% to 10% for life – depending on exact guarantees or features selected. Obviously, interest rates are nowhere near 8% to 10%.5 A portion of this yield is regular interest plus mortality credits; the rest is the original premium returned over time. Generally, the older the purchaser, the greater the impact of mortality credits on yield. This is quite similar to how it worked three centuries ago. The surviving 90-year-olds reaped enormous rewards. Those who died prior to life expectancy subsidized those who lived longer than the assumed expectancy. That is exactly the nature of insurance. It is protection.

DIA vs. SPIA

A modern deferred income annuity takes the concept of mortality credits to the next level by reaching farther out on the ‘time curve’ to credit higher interest and higher mortality rates. In a typical SPIA, the purchaser (annuitant) might spend $150,000 at the age of 65 to guarantee lifetime income of $10,000 beginning immediately. In contrast, in a DIA, a 55-year-old purchaser might spend $80,000 (spread over a payment period of a few years), but the income would begin at the age of 70. The same benefit of $10,000 per year DIA is much cheaper than the $10,000 per year SPIA because it is purchased earlier and begins later. This is all hypothetical. In the next section I’ll get to actual prices.

As far as flavors are concerned, there are many DIA choices available. The buyer of a DIA can stipulate that they receive $10,000 per year guaranteed for 10, 20 or 30 years, or that the income continue to the last surviving spouse. A DIA buyer can ask for a death benefit (or refund) in the event they die before getting back the principal. The DIA buyer can also purchase inflation protection so that the $10,000 increases at 1%, 2% or even at the Consumer Price Index (CPI).

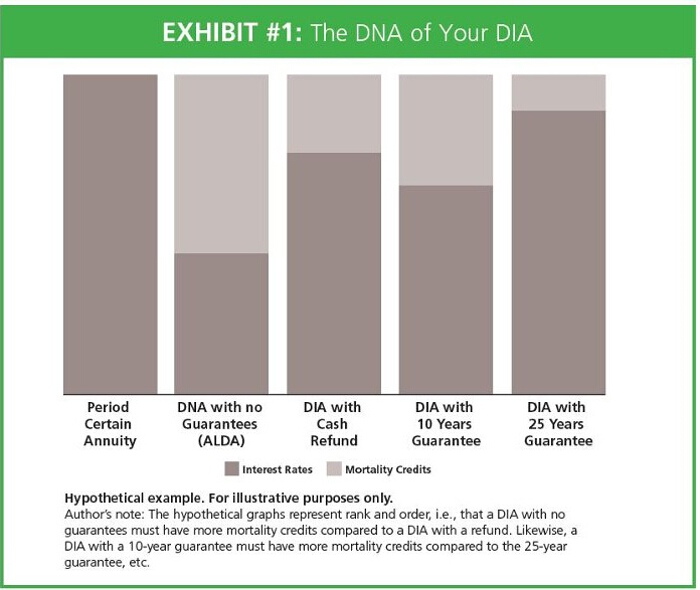

Notice that these are all features available on regular SPIAs – nothing different in a DIA – but they do cost more and dilute the value of the mortality credits. Exhibit #1 provides some indication of how different features water down ‘mortality credits.’ The pure DIA without guarantees or refunds provides the most income levels, but understandably is viewed as a gamble with longevity insurance that most people prefer not to take. Ultimately though, DIA pricing comes primarily down to the time value of money and the inevitable force of mortality.

Timing of Purchase

Is now the best time to purchase a DIA? After all, even if the interest rate component is relatively small, doesn’t it make sense to wait until rates have gone up? Won’t the $10,000 DIA get cheaper once the Fed increases rates? The quick answer to the first question is: No; and to the last: Not necessarily. I’ll return to both of these issues.

The next section [#2] examines the impact of the yield curve or the term structure of interest rates on the pricing of DIAs. You might be surprised to learn that even if interest rates do rise, falling DIA (or even long bond) prices aren’t a slam-dunk. Readers not interested in the technicalities are welcome to skip to section [#3], where I discuss the types of DIAs that consumers are actually inquiring about. Section [#4] concludes the white paper with some investment suggestions and a final call to action.

2. The Yield Curve and Long-Term Annuities

A common misunderstanding about interest rates is that they can be described with one single number – like a temperature or a weight – which can move up or down in a given week or month. While this might be true for specific benchmark rates (e.g. Fed Funds or LIBOR or 10 Year Note), the more accurate way to describe and think about interest rates is as an extended CURVE that stretches out from tomorrow to over 50 years. Each point on the curve represents a different maturity date. This entire curve can move up-and-down or twist-and-turn all at once or on any given day. The two-year interest rate might increase while the 20-year interest rate might decline, and vice versa.

The practical implications of this financial fact are that while many forecasters and economists appear confident that the U.S. Federal Reserve will soon increase short-term rates, there is no guarantee that all points on the curve will increase in tandem, or even increase at all.

The consequences for life annuity pricing are rather subtle. Namely, a year or two from now interest rates might indeed be higher at the ‘short’ end of the curve, as anticipated. Paradoxically though, certain hypothetical bond (and annuity) values might also increase, as they are tied to the ‘long’ end of the curve.

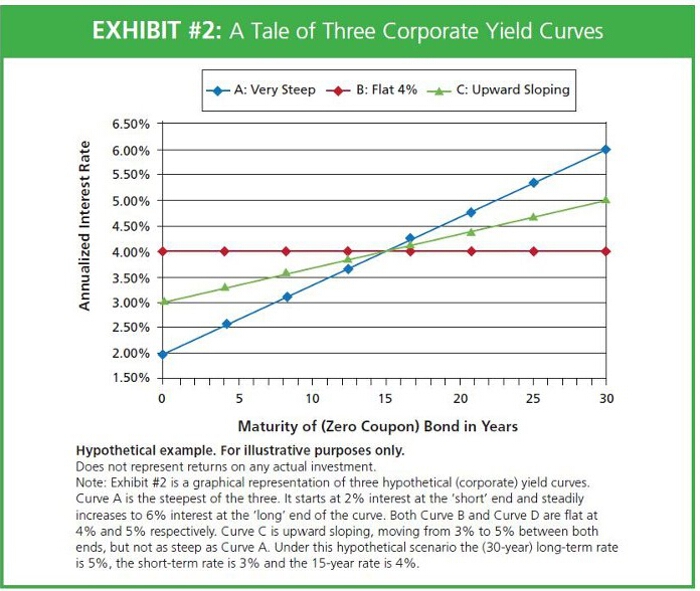

To understand this fact, which at first might sound counter-intuitive, I offer the following thought experiment. Exhibit #2 is a graphical representation of three hypothetical (corporate) yield curves, a.k.a. the term structure of interest rates. Curve A is the steepest of the three. It starts at 2% interest at the ‘short’ end and steadily increases to 6% interest at the ‘long’ end of the curve. At the 15-year mark, it clocks-in at 4%. Under Curve A, if a relatively large/safe corporation borrows $100 for 15 years, it must pay 4% interest (for the 15 years), but if it borrows for 30 years, it must pay 6% interest (for the 30 years.) The spread between the long-end and the short-end is 400 basis points! Note that the U.S. Treasury bond yield curve which doesn’t include a credit risk premium (in late 2014) is steeply upward sloping, although the exact numbers are different and the lines aren’t as smooth.

In contrast to Curve A, hypothetical Curve B is flat. In this world, the interest rate a corporation pays creditors is 4% per year, regardless of whether it is borrowing for 1, 15, or 30 years. Sure, it has to pay more interest (in dollars) the longer it wants to borrow, but the annualized RATE is the same.

Finally, Curve C is upward sloping but not as steep as Curve A. Under this hypothetical scenario the (30-year) long-term rate is 5%, the short-term rate is 3% and the 15-year rate is 4%. Now, although the exhibit itself doesn’t continue beyond 30 years, the lines are all assumed to flatten out at their 30-year rates (forever). The key observation here is that the 30-year average interest rate across all three curves is exactly 4%. The averages are all the same, but they can be deceiving.

Pricing Analytics and Intuition

Now, imagine that you want to purchase a long-term annuity, paying you $10,000 per year in semi-annual installments, from years 15-50. I call this a ‘fifteen-to-fifty’ year delayed period certain annuity (DPCA) which, I admit, is a mouthful. Just to be clear though, the DPCA isn’t a life annuity or DIA (quite yet) because there is no longevity-contingent income. This is a portfolio of corporate zero-coupon strip bonds. For the first 15 years you get absolutely nothing, then you or your heirs are entitled to $10,000 per year from year 15 to year 50. In total, you will receive $350,000 in payments. The DPCA will serve as a comparison point (and product) for most of what follows.

Quiz Time

Question.

What is the value of this ‘fifteen-to-fifty’ year annuity (DPCA) under the steep Curve A? And, would it be cheaper or more expensive in the world of Curve B or Curve C? Recall from Exhibit #2 that the interest rate averages 4% across all three curves.

This question has absolutely nothing to do with mortality credits, actuarial assumptions or insurance reserves. This sort of ‘fifteen-to-fifty’ year DPCA could be manufactured or sold by any financial intermediary. My question is: what should it cost?

Answer.

In the world of Curve A, where interest rates stretch from 2% to 6%, the value of the ‘fifteen-to-fifty’ year DPCA is exactly $73,450. The ‘proof’ is straight mathematics in which the $5,000 cash flows are discounted by the appropriate rate every six months, from years 15-50. Though you will be receiving a total of $350,000 in payments, the present value is only a fraction of that number because of the impact of discounting, a.k.a. the time value of money.

Another way to think about this is that the payout yield (starting in year 15) would be $10,000 / $73,450 = 13%. It sounds high (at first) but remember that you get nothing for a decade-and-a-half while you wait. Don’t confuse payout yield (13%) with embedded interest rate (which is 4% average over the curve.)

Under the less steep Curve C, the DPCA is valued at $87,500, which is approximately 20% more expensive. Surprise. You move from Curve A to Curve C – in which interest rates at the short end actually move up – but the value of the ‘fifteen-to-fifty’ year annuity grows. If this change happens overnight (Feds raise short-term rates) then you would have to pay $87,500 - $73,450 = $14,050 more for the exact same future cash flow. Why? The tail (long) end of the curve is generally much more important than the head (short) end of the curve when pricing long-term annuities.

Who is to say how today’s yield curve will evolve? When the Feds finally do raise (short) rates, will the long end of the curve move up or down? Will inflation expectations be dampened? It is hard to tell and even more difficult to forecast.

In fact, going from Curve C to (flat) Curve B, the value of the ‘fifteen-to-fifty’ year annuity increases (even higher) to $106,700 up front, which is 45% more expensive than the Curve A value. Short rates have jumped (dramatically) but the long-end drives the pricing.

For comparison purposes, if the annuity was of the ‘ten-to-fifty’ DPCA variety, which starts income in year 10 and continues for forty years ($400,000 in total) until year 50, the value under Curve A would be $105,750. This is higher than the $73,450 (the value of the ‘fifteen-to-fifty’ annuity) because the income starts five years earlier and more money costs more.

And Now for Some DIA Prices

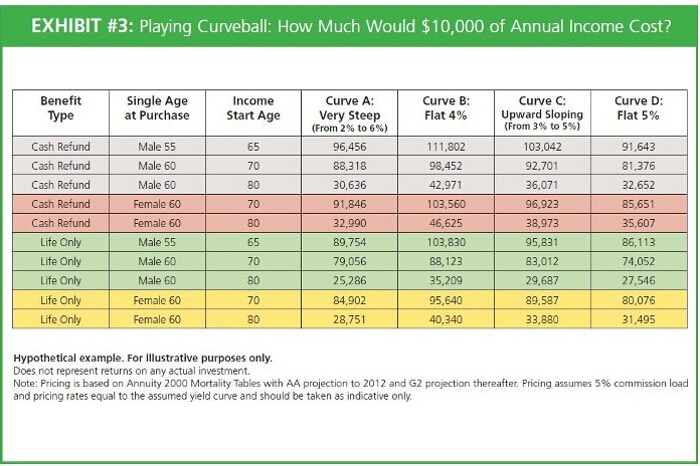

Recall that a DPCA is just a portfolio of strip bonds (in the eye of capital market specialists or bond traders.) It has no mortality or life contingent component. Exhibit #3 provides some indication of what a DIA with different benefit features would cost assuming the same types of curves I discussed above. Note that these numbers don’t represent any particular company’s current price – per se – since they can change daily, but are priced assuming the world conformed to a variety of hypothetical curves. I have listed the three original scenarios, A, B & C and added a new fourth, Curve D, in which the interest rates are a flat 5% across the curve.

Here is how to read and interpret the DIA numbers. Start with the first row in this hypothetical. This represents a 55-year-old male who purchases a DIA with guarantees that ‘buys’ $10,000 of annual income starting at the age of 65, but would like a cash refund feature. This means that if he dies prior to receiving his entire purchase payment back, the heirs or beneficiaries would be entitled to the purchase payments less any income payments received. Compare this to the aforementioned ‘ten-to-fifty’ DPCA, valued at $105,750. Unlike the DPCA, the DIA income is contingent on life, so the cost under Curve A would be $96,456 up-front. This number comes from a (rather messy) actuarial pricing algorithm. But, the key item is that DIA is cheaper because of the mortality credits. It is almost 8.8% cheaper, to be precise.

Notice how (in Exhibit #3) different initial ages, genders, benefit types and curves impact the value (i.e. the price) of the DIA. In particular, notice how when moving from Curve A to Curve C, where short-term interest rates have increased, the cost of the DIA actually increases. This is based on the same logic I presented earlier. In the case of the hypothetical purchase payment scenarios presented for Cash Refund DIA for the 55-year-old, the price jumps from $96,456 (under A) to $103,042 (under C) to $111,802 (under B). It is only under the (new) scenario D – where rates moved to 5% across the entire curve, that the DIA purchase price drops to $91,643.

So yes, if you are living in a ‘Curve A world’ and are absolutely convinced that tomorrow you will be living in a ‘Curve D world,’ then wait for the DIA price to decline from $96,456 to $91,643. But you had better be certain.

Another thing to note is how much cheaper under all curves in this hypothetical, the Life Only (20-year-delay) income annuity is for both the 60-year-old female and for the 60 year old male. For example, for a female, the cost is $28,751 in the ‘Case A world’ and it gets more expensive in any of the B, C or D worlds.

Insurance Quotient (IQ)

Putting this all together, here is how to summarize and position these ‘mortality credit’ values and rates with one simple number. Recall that a ‘ten-to-fifty’ year DPCA (under Curve A) would cost $105,750, but the indicative quote for a DIA at age 55 is $96,456, which is $9,294 lower. This $9,294 gap or discount as a percentage of the $105,750 (non-life contingent version) is 8.8%, which is solely due to the mortality credits. Consequently, the DNA of this particular DIA indicates that 8.8% is mortality credits and 91.2% is interest credits. I prefer to use the term Insurance Quotient (IQ) of 8.8%, which offers a more quantitative interpretation of Exhibit #1. The discount you receive – relative to the deferred period certain annuity (DPCA) – represents another way of measuring the mortality credits.

Using the same methodology, but comparing the DIA at age 60 (life only, starting in twenty years) to the ‘twenty-to-fifty’ annuity under the same Curve A results in an IQ number of 41.6%. Intuitively almost 40% of the DNA of the twenty-year DIA for a 60-year-old is due to mortality credits. The other 60% can be sourced to interest.

Personally, I favor numbers closer to the 40/60 mix of mortality over interest. 40/60 isn’t just a popular slogan. It is closer to the Advanced Life Delayed Annuity (ALDA) concept favored by financial economists.

In sum, my main points are as follows:

1. The pricing of a DIA is based on (current) long-term interest rates and (expected) mortality rates. The Fed’s (short-term) actions are less important than you think – as prices depend more on long-term rates.

2. Waiting for rates to rise – and DIA prices to get cheaper – can be risky for three reasons. First, the purchaser may be wrong on the long end of the curve and in an upward sloping environment they will be “moving down the curve.” Second, people might be “living longer” which will manifest itself in higher annuity prices. Third, the purchaser misses out on the mortality credits in the meantime.

Here is another way to see the impact of mortality credits and how they can serve as a partial buffer from the volatility of interest rates. Under a flat 4% (Case B) yield curve, a $100,000 investment in a ‘fifteen-to-fifty’ year DPCA would generate $9,368 in annual income starting in year 15. In comparison, a pure life DIA under the same interest rate assumption and a 2% per year mortality assumption (e.g. someone at age 55) would generate $16,227 starting in year 15. The extra income from the same $100,000 investment is due to the mortality credits.

Now, if interest rates (suddenly) rise by 100 basis points across the entire curve – from 4% to 5% – then the value of both annuities will decline, with the ‘fifteen-to-fifty’ year annuity priced at $76,540 and the pure life DIA at $77,814. Note that the DIA has declined less than the ‘fifteen-to-fifty’ year annuity (a.k.a. bond). Technically speaking, the DIA’s duration is lower and the mortality credits partially shield against interest rate risk.

Increasing Sustainability

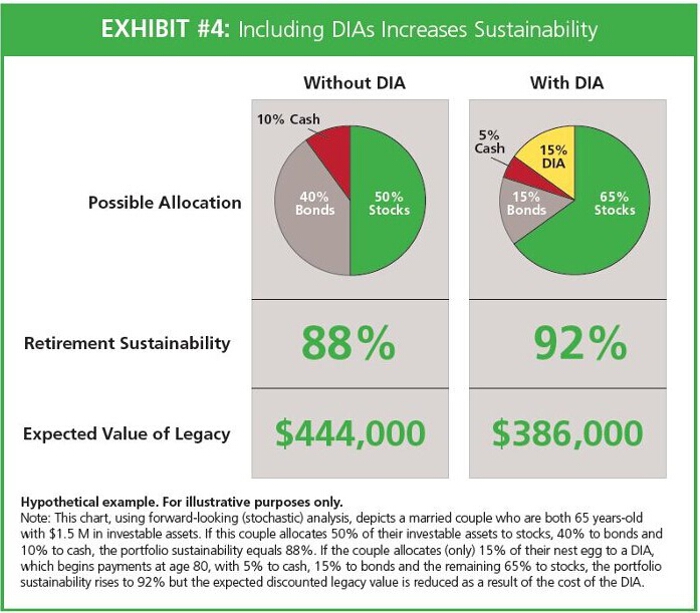

The ‘value’ of the DIA in a portfolio can also be quantified by measuring the impact on portfolio sustainability. Exhibit #4 displays the result from a forward-looking (stochastic) analysis of the sustainability of two different portfolios. In the first one there is no DIA included, and in the other approximately 15% is allocated to a DIA. The bottom line is that the sustainability of the portfolio is 4 percentage points higher, when the DIA is included – which also allows for greater risk exposure.

To be specific, the simulation analysis – which is idealized and meant only as a generic illustration – assumes a married couple (M/F) who are both 65-years-old and have $1,500,000 in investable assets. The couple is entitled to $35,000 in total Social Security (i.e., real inflation indexed life annuities) benefits but would like to spend an additional $60,000 per year for a total of $95,000. According to the stochastic analysis, if this couple allocates 50% of their investable assets in stocks, 40% in bonds and 10% in cash, the sustainability of their retirement income plan would be 88%, which isn’t bad, but can be improved. Indeed, if this couple allocates (only) 15% of their nest egg to a DIA which begins payments at the age of 80, and then 5% to cash, 15% to bonds and the remaining 65% to stocks, the sustainability of the plan will increase to 92%, which is a higher level of confidence. Notice how this DIA + Stocks + Bonds allocation involved more equity risk (65% vs. 50%) but the overall ‘risk’ of the plan is reduced because the DIA acts as a hedge against longevity risk.

With all the analytics aside, in the next section I’ll examine the types of DIAs that people are actually buying.

3. What Types of DIAs Are Consumers Interest In?

Although the 21st century version of the DIA is relatively new, and some insurance companies offer (slightly) different features and guarantees than others, there are clear preference trends in the DIA market. Overall, it appears that purchasers are: spending large amounts on DIAs, concerned about flexibility and financial protection for their heirs, but are not very interested in paying extra for inflation protection. In other words, they don’t seem as anxious about the lifetime purchasing power of their money as one might expect from theory.

Before I elaborate, I should clarify that I do not have access to actual transaction or purchase information for DIAs. So, I don’t know the exact DIAs consumers are purchasing. Rather, I have data on the features consumers are requesting before they ‘sign on the dotted line.’

Indeed, it is common practice (and often a requirement) for licensed financial advisors, brokers or agents to obtain a formal comparison ‘quote or survey’ for a DIA before they finalize the transaction. They may scan the market for similar products prior to selecting a particular company and purchasing their specific DIA. The analytic process of comparison-shopping is a common procedure. Of course, other factors to consider when doing this analysis include the reputation of whoever is backing the guarantee and any other features or flexibility available in the product.

Anyway, this rich and diverse ‘quote survey’ data is available from CANNEX Financial Exchanges, a company that manages and warehouses the underlying annuity pricing algorithms. CANNEX has allowed the use and summary display of this information.

What follows is a statistical analysis based on the more than 110,000 surveys generated during the first six months of 2014. I am reasonably confident this is a valid sample capturing actual purchase behavior, which is why I use terms such as request or ‘invest’ or ‘purchase’ instead of the generic phrases ‘survey’ and ‘quote ’. All technicalities aside, here is a high level summary of DIA features consumers actually inquire about.

Not surprisingly, while a finance and insurance theorist (such as myself) would advocate for ‘pure longevity insurance’ with high values for the IQ number, the data indicates that few people who buy DIAs are attracted to the academic version.

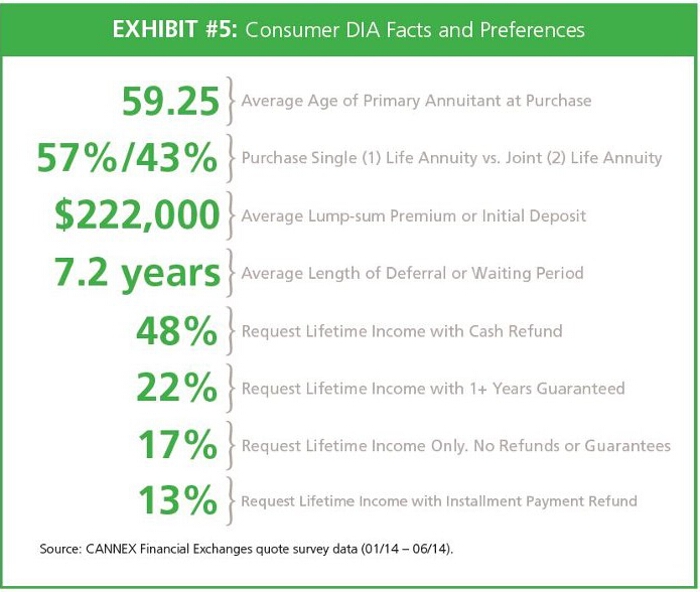

The average age at which purchasers start buying DIAs is just slightly before age 60 (59.25 to be precise). In terms of life contingencies they inquire about, 30.3% of purchases are for single-life males, 37.2% are joint-life in which the male is the primary annuitant, another 26.3% are for single-life females, and a final 6.2% are joint-life with a female as the primary annuitant. Stated differently, 57% of DIA purchases are single life-contingencies and 43% are for two lives, protecting a couple.

The average deferral or delay period – which is the number of years between the purchase age and the age at which the income is expected to begin – is 7.2 years. This implies that the average age of ‘financial retirement’ defined as the point at which the money is withdrawn, is 67, which is quite early relative to the ‘theoretical ideal.’ One can infer that, while the optimal deferral period is longer, consumers are selecting earlier start dates for income for a variety of reasons, such as predictability of lifetime income or in case they need to access the money. One might speculate that having the ability to take (some) income early and defer the remainder would be appealing and consumers might initially select longer deferral periods, closer to the ‘theoretical optimum.’ Either way, Exhibit #5 provides a summary table of the main DIA features being purchased among those currently available.

Notice that 48% are requesting a ‘cash refund’, which is a type of guarantee or feature that offers protection to beneficiaries. Upon death of the last annuitant, the beneficiaries receive a lump-sum payment of the original premium, net of any payments already received by the annuitants. A further 13% are requesting ‘installment refunds’ in which the original premium (net of payments) is returned over a fixed period of time. In fact, only 17% are requesting or selecting a life-only product with no additional guarantees or features. Earlier, I called this the purest form of longevity insurance – although clearly not very popular. Individuals may perceive guarantees as a way to protect themselves financially from both living too long and dying too early. Think of this as a type of life insurance.

In terms of tax-status, 55% of quotes are Non-Qualified and 45% are in Qualified Individual Retirement Accounts (IRAs). This is important to note because the tax treatment of income received from the DIA will be 100% taxable as (ordinary) income in the Qualified IRA. But, with the Non-Qualified version, a portion will be treated as a return of original principal and tax-favored. In other words, part of the cash flow does not have to be added to taxable income and will be exempt from tax until the original principal is recovered. This might be viewed as yet another advantage of the (non-qualified) DIA relative to a conventional coupon-bearing bond or fixed-income mutual fund. Recall that 100% of (non-municipal bond) interest and coupon income is fully taxable although you maintain the principal which is lost in the DIA. One thing is for certain, when purchasing a DIA with Non-Qualified funds it is very important to determine the portion of income considered non-taxable.

There are some additional items worth noting. By construction and design, DIAs are (very) long dated fixed income instruments with much greater sensitivity to levels and changes in anticipated inflation. Yet, few consumers seem interested in paying for Consumer Price Index (CPI) or even Cost of Living Adjustment (COLA) protection. Less than 1% request CPI-linked income and less than 9% select any COLA protection whatsoever. In other words, over 90% are satisfied with nominal (non-inflation protected) cash flows. Quite telling.

A few other final factoids are worth logging. As far as frequency of income is concerned, 20% of buyers are interested in annual income and the other 80% prefer the income on a monthly basis.

Independently, 60% of buyers request detailed rating information on the credit quality or financial safety of the issuing insurance company. Evidently, they understand that with such long dated and illiquid investments, the history, stability and security of the company is of utmost concern, as it should be. To them, yield, payout and cost – or the typical “spreadsheet factors” are just part of the decision equation. The other 40% don’t seem to care about credit ratings.

I conclude with a reminder (and disclaimer) that the above statements are based on ‘surveys’ as opposed to actual purchases. Nevertheless, proper care has been taken to remove biases and it is my professional opinion these takeaways are representative of behavior at the aggregate market level.

In sum, consumers who are purchasing DIAs with relatively large sums, value flexibility, guarantees and safety. Apparently, (much) less than 20% are selecting the commoditized version of pure longevity insurance with the maximum amounts of mortality credits. The majority of buyers aren’t willing to take too big a chance with their longevity insurance – and rightly so. Even a financial economist would agree that preferences for bequest and legacy can change over time.

4. Investment Life Cycle

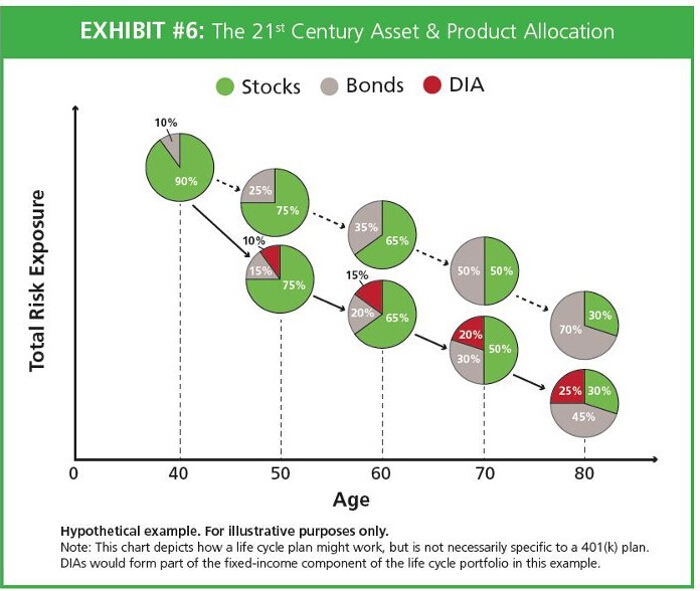

Single premium immediate annuities and deferred income annuities are usually positioned as pension replacements for the ‘pension-less.’ This financial planning framework helps retirees properly budget for their expenditures and hedge retirement risks using longevity insurance. I believe that the conventional financial planning approach should be augmented with an asset allocation framework. Namely, DIAs should (also) be positioned as a fixed income component for the retirement portfolio. In a nutshell: Everyone must own some bonds as they age, so why not replace some of them with (better) bonds, i.e. bonds with mortality credits.

Here is the paradox. One of the concerns expressed in the current economic environment question is: “What if the U.S. Federal Reserve is about to increase interest rates? Does that mean now is not a good time to lock-in the price of lifetime income?” And yet many people own bonds in their retirement portfolio. Alas, if they were 100% certain that bond yields are headed up, they would own 100% equity or cash. Moreover, starting the process of slowly buying DIA units might alleviate concerns over the timing risk and this dollar-cost averaging strategy can be rigorously justified in a dynamic life cycle model for a sufficiently risk averse consumer. Notwithstanding the pension-like benefits of DIAs, they are also fixed-income investments with a higher yield due to mortality credits. This is the essence of the modern retirement income tradeoff. Should I surrender liquidity in exchange for longevity insurance protection?

The Treasury Thinks So.

In late October 2014, the U.S. Treasury Department’s Office of Public Affairs issued a press release in which it announced the issuance of guidance to encourage the use of life annuities in 401(k) plans. In particular, the guidance made clear that “plan sponsors can include deferred income annuities in target date funds used as default investments.” The statement went on to say that: “A deferred income annuity provides an income stream that generally continues throughout an individual’s life, but is not intended to begin until some time after it is purchased.” This announcement was coordinated with the U.S. Department of Labor, which, in an accompanying letter to the press release, confirmed: “target date funds serving as default investment alternatives may include annuities among their fixed income investments.”

Exhibit #6 is a visual of how the life cycle plan might work, which can be applied generally and is not necessarily specific to a 401(k) plan. Namely, DIAs would form part of the fixed-income component of the life cycle portfolio and would further reduce lifetime (income) risk. Now, although the U.S. Treasury’s guidance is referring to 401(k) plans and target date funds (TDF) – and it is not suggesting that investors replace bonds with DIAs, only saying that is allowed – the spirit of its remarks is the main notion underlying this article.

In fact, in an equally relevant development, on July 1, 2014, the U.S. Treasury Department and the Internal Revenue Service (IRS) issued regulations that allowed defined contribution (DC) and individual retirement account (IRA) markets to offer qualified longevity annuity contracts (QLACs). Needless to say, before these regulatory changes, DC and IRA investors could not purchase longevity annuities since they were designed to start income distributions after the required age of 70½. Within certain limits, QLACs are now exempt from required minimum distribution rules and will not be reported as a market value holding like other qualified investments. These QLACs allow a number of important features, including return of premium death benefits, a higher maximum investment amount and protection against disqualification from the annuity purchase as a result of paying premiums that exceed the limits.

These regulatory developments further show that the authorities want to encourage (or bless) the purchase of products that protect against longevity risk.

5. Conclusion

Call to Action: Swapping Bonds with DIAs

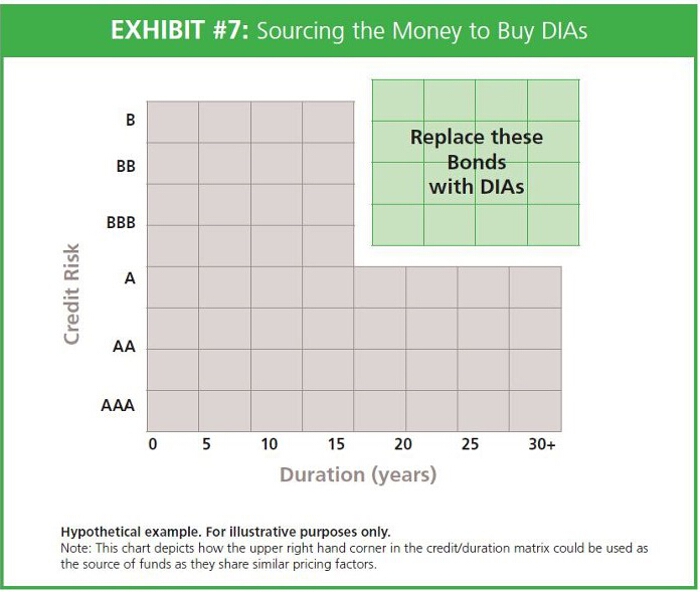

I am suggesting that individuals who are approaching retirement ‘swap-out’ some of their fixed income holdings and replace them with deferred income annuities. As I have argued, there are strong similarities between long-term bonds and DIAs. They are both sensitive to long-term rates, but the mortality credits provide an added buffer. If purchasers are to source funds for use in buying a DIA and they ask, “Where should I get the money?” The ideal response would be, “From long-term, fixed-income holdings.”

Exhibit #7 illustrates how the ‘upper right corner’ in the credit/duration matrix could be used as the source of funds since they share similar pricing factors.

In sum, in the late 17th century, income annuities were used to help finance retirement, hedge longevity risk and generate a source of regular income. At the time, mortality credits were highly unpredictable and the cash flows were uneven. Over 300 years later, the insurance industry has improved on this model, but the underlying DIA idea is exactly the same.

As King Solomon once said: There is Nothing New Under the Sun.

We'd love to hear from you!

Please post your comment or question. It's completely safe – we never publish your email address.

Comments (0)

There are no comments yet. Do you have any questions?