The New Way to Get IRA Income

Thanks to a government rule on annuities, retirees can be rewarded for their patience.

This article appears at the following website: time.com/money

For years, financial planners have touted the benefits of longevity annuities for retirees. Now a new IRS rule has made these income generators an even better deal.

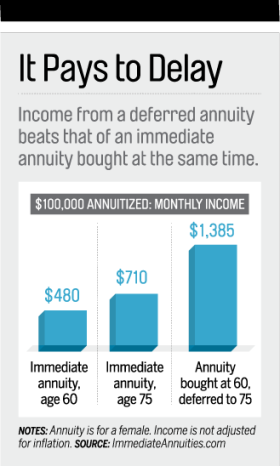

With a longevity annuity—also called a deferred income annuity or longevity insurance—you pay a lump sum in return for monthly income for life, starting at some future date. Because the issuer assumes that—let’s just say it—some buyers will die before they start receiving money, or soon after they do, your monthly check will be far more than you would receive from an immediate annuity costing the same (see the chart below). A longevity annuity’s larger, delayed payout helps hedge against the risk of outliving your money. It also frees you up to invest more aggressively in the rest of your portfolio, because you know you’ll have this income later on.

Under a rule passed last year, if you use IRA funds to buy a longevity annuity meeting certain IRS guidelines, its cost—up to $125,000 or 25% of your account, whichever is less—won’t be used in calculating the required minimum distributions you have to take from your retirement account starting at age 70½. Such a qualified longevity annuity contract, or QLAC, as it’s known, lets you leave more money to continue growing tax-free in your portfolio. To decide whether a longevity annuity is right for you, follow these steps:

Assess your cash situation

As useful as the annuity can be, you have to balance that future income stream with your need for money that you can tap for emergencies, either now or later. So commit only a small portion of your portfolio— no more than 20%—to a deferrred annuity, suggests Michael Finke, financial planning professor at Texas Tech. “The sweet spot for buying a deferred annuity is $500,000 to $1 million or more in retirement assets,” he says. Less than that, and you won’t be able to purchase much income; more than that, and you can likely fund your future needs without annuitizing.

Make sure you can wait

Some buyers of longevity insurance are workers who plan to defer their annuity only until they retire, often within 10 years. But to maximize your benefit, defer 15 years or longer and wait until you’re in your seventies or eighties. Otherwise, you won’t get a big income bump from the issuer’s expectation that a certain number of buyers like you won’t collect. “If you can’t afford to wait more than a few years, there’s not much advantage over an immediate annuity,” says York University finance professor Moshe Milevsky.

Get ready to research

Several insurance companies have started selling QLACs, including Principal Financial and American General. You can get quotes for them at ImmediateAnnuities.com.

So your money will be there when you need it, stick with insurers rated A+ or better by A.M. Best or Standard & Poor’s, says Coral Gables, Fla., financial planner Harold Evensky. After all, the whole point is to have fewer financial worries in retirement.

We'd love to hear from you!

Please post your comment or question. It's completely safe – we never publish your email address.

Comments (0)

There are no comments yet. Do you have any questions?